Needless F****** Things

Part one of a *really* deep dive into the world of NFTs

I’ve always wanted to make a living as an artist, but so far, life hasn’t found a way.

What’s frustrating is not that I’ve had no success; it’s that I’ve had some. Just enough for a taste. When I marshal my scattered attention for long enough, I can mix my humour and limited painting ability into some weird blends that people seem to genuinely dig and that I’m still proud of.

Over several years, I painted and auctioned weird portraits of New Zealand politicians the rest of the world is lucky enough not to know about, which went a tiny bit viral. Partly because of this, I managed to finagle a place at an illustration convention called Chromacon. The only problem was that I didn’t have much to exhibit.

Birds with Hats:

What to paint? I like birds, but I needed to differentiate myself from hundreds of other Kiwi artists who like birds too. I also like Lord of the Rings, and silly puns. As an experiment, I painted a Riroriro (Grey Warbler) wearing a wizard hat, and called it Gandalf the Grey Warbler.

I enjoyed the joke and the painting so much I did three more just like it, quadrupling my last five years or so of art output in about two weeks. I got some prints and an online shop made in time for the exhibition, and as an afterthought, I put some pics up on Reddit. My post got popular enough that quite a few people bought prints. Success!

A real live human:

A few years later, having painted several more birds, I started a YouTube channel where I painted scenes from video games using techniques learned from watching living meme Bob Ross. This was just starting to get a bit of traction when my wife and I received my best excuse yet for not making art: a baby. I didn’t paint or draw anything for about 12 months — until David asked me to do some illustrations for the Webworm I wrote about climate change.

That’s most of the highlights from the last ten years. While it’s fair to say there’s been some success on the art front, my artistic inconsistency — plus the opportunity cost of leaving a job that pays for one that mostly doesn’t — have tanked the idea of doing art full-time.

So when I saw a Webworm article on how some artists were making a living from NFTs, I was genuinely interested.

The only problem was that NFTs are built with the same technology that powers cryptocurrency. And I know just enough about crypto to hate it.

Pollution, monetized

To my mind, cryptocurrency is explained most brilliantly by The Hitchhikers Guide to the Galaxy. Typically, author Douglas Adams managed to do this despite having died eight years before Bitcoin first appeared. The scene: a bunch of humanoid aliens (comprised of the “useless third” of their planet’s population, which includes marketers, management consultants, and documentary makers) have crash-landed on prehistoric Planet Earth and are looking to set up a new society. Here, let me plagiarise:

“If,” the management consultant said tersely, “we could for a moment move on to the subject of fiscal policy. Since we decided a few weeks ago to adopt the leaf as legal tender, we have, of course, all become immensely rich.”

Ford stared in disbelief at the crowd who were murmuring appreciatively at this and greedily fingering the wads of leaves with which their tracksuits were stuffed.

“But we have also,” continued the management consultant, “run into a small inflation problem on account of the high level of leaf availability, which means that, I gather, the current going rate has something like three deciduous forests buying one ship’s peanut.”

Murmurs of alarm came from the crowd. The management consultant waved them down. “So in order to obviate this problem,” he continued, “and effectively revalue the leaf, we are about to embark on a massive defoliation campaign, and. . .er, burn down all the forests. I think you’ll all agree that’s a sensible move under the circumstances.”

Critics who actually lived to see crypto have been even less kind: it is, they say, valueless except as a greater-fool investment; a truly colossal, tech-driven Ponzi scheme that gets by on market manipulation and an endless supply of newbies hoping to get rich.

You could, of course, make a similar claim about the global financial system, neoliberalism, or even capitalism. Banks create money from nothing, leverage crisis for record profits, and lobby against regulation. Wall Street is a corrupt casino run by byzantine financial interests with extraordinary wealth and influence on power. We’re entering a new monopolistic era where there are a few dozen hyper-corporations driving inflation through rampant profiteering, and a million minnows fighting over scraps.

Those who profit most from this fundamentally unjust system face no consequences; instead they squirrel away their multi-billions in quasi-legal tax havens or blast themselves into space for kicks. Meanwhile, the exhaust gases from this great, mindless machine are setting our only home ablaze as increasingly panicked millions try desperately to puzzle out what the fuck to do. It’s not hard to see why people are so emotionally invested in what looks like an alternative.

But cryptocurrency is just another head of the same hydra, and contrary to its name, it doesn’t really work as currency. As corrupt and unjust as the financial system is, at the end of the day, I can buy food with the fiat currency that appears in my account each week, sent in exchange for the labour I put in at my job. The transactions flash through in seconds - from my job to my account, from my account to the supermarket. This is not true of crypto. The biggest currencies have decentralized databases so big and so unwieldy that transactions can take hours, or days.

Of course, there are use cases for cryptocurrency. It’s fantastic for speculation, scams, blackmail, unregulated market manipulation, and buying illegal products on the dark web. While those things are obviously problematic, it’s made much worse by the fact that all those transactions don’t just take a long time; they use an incredible amount of energy. As of 2021, Bitcoin alone used more electricity than a country the size of New Zealand.

A proof-of-work cryptocurrency like Bitcoin or Ethereum relies on cracking harder and harder math problems in order to verify transactions. While the actual mechanics of this are beyond me, this is roughly what “mining” is: computers compete to verify transactions, and winners get thrown a crumb of coin to incentivize them to keep going. All this computing activity requires enormous amounts of electricity, which comes from either a) burning carbon or b) using renewable energy that could be powering homes, but is instead powering a rack of gaming GPUs.1

Here’s the simplest way to put it: Proof-of-work cryptocurrencies are monetized pollution. They might be the most asinine example of late-stage capitalist absurdity yet invented. I wasn’t always this cynical about it; years ago I even did a bit of freelance work for some really good people at a crypto outfit that used a less environmentally ruinous approach called “proof of stake”. But after watching the field for a decade or so and seeing the technology produce nothing useful, I just kind of tried to ignore it.

Enter NFTs

When NFTs appeared, it appeared that crypto might finally have a decent use case. Even more fascinatingly, that use case seemed centered on enabling artists to make a living from their work. When David’s Webworm about Richard Parry – an artist I’ve admired from afar for a long time, thanks to our overlapping interests in art based on puns, birds and video games — appeared in my inbox, I was fascinated to see he was making an absolute killing. Others were doing even better. Mike Winklemann, aka Beeple, sold a single NFT for $69 million. Nice.

I had a look online to see what people were saying. My Twitter bubble, made mostly of artists and journalists, hated NFTs. But Twitter hates everything — cynicism is currency and a great way to gain followers is to look savvy by being a snide know-it-all. So maybe that wasn’t the best source. I checked elsewhere. Some tech sites were cautiously optimistic, others dismissed NFTs as a grift.

It seemed I couldn’t find an off-the-shelf opinion I was happy with. So I tried to purge myself of preconceptions and go in fresh. I would do my own research.

This... may not have been a good idea.

I’ll talk more about what I found shortly, but first I should explain what NFTs actually are. An NFT is a receipt. Simple, right? But because the blockchain adds layers of needless complexity to even simple concepts, I guess we’d better dive into yet another crypto rabbit hole.

Needless Fucking Things

The acronym “NFT” stands for “non-fungible token.” What does that mean? While it sounds vaguely mycological, all it means is that it’s a record of a transaction that lives on the blockchain, that can’t be altered, and that can store a small amount of data. Which, in itself, means nothing. It’s just a string of numbers and letters. Look, here’s an NFT. Gaze upon it — this thing last sold for $25 million USD:

0xb47e3cd837dDF8e4c57F05d70Ab865de6e193BBB

Like leaves, or snowflakes, every NFT is unique. They’re also like leaves in that they don’t have any inherent value. In fact, you could argue NFTs have even less inherent value than leaves, because leaves remove carbon from the atmosphere and NFTs do the opposite. They differ from leaves in one important respect: unlike most digital properties, which are designed to be copied, NFTs are made to be scarce, because they’re on the blockchain. (As in Douglas Adams’ prescient example of burning down forests to make leaves more valuable, the blockchain creates artificial scarcity by burning carbon.)

As humans, we’re used to assigning value to random things. The paper my New Zealand dollars are printed on isn’t really worth anything, but because we collectively agree that money is both scarce and representative of the value created by economic activity, worthless paper acquires value (signified by some special artwork) and I can exchange it for goods and services.

Because an NFT is just a string of numbers corresponding to a blockchain file, its value comes not from scarcity alone, but also the information it stores. Individual Ethereum entries can only store a small amount of data, so NFTS are often just links to something else, usually a digital file stored on a server. These files can be pretty much anything — jpegs, video game assets, documents, you name it. An NFT says: “see that thing? Well, this guy has an NFT of it.”

This is where it gets thorny. Having an NFT isn’t in itself proof of ownership of the file it’s linked to; it’s just proof of… having an NFT. Ownership in society is usually assigned through a central authority: the law and its enforcers. For example, if I nip into the Louvre and grab the Mona Lisa, the local centralized authority — the French Government — will be unhappy, and they will express their sadness by throwing me in jail. But if I copy a file linked to an NFT, no-one can do jack shit. Even if I steal someone’s actual NFT, by hacking or trickery, the legal remedy is often unclear. The blockchain itself has no answer for this, because it’s very hard to undo transactions and is decentralized by design.

To date, few in the NFT scene seem to care about the philosophical plot holes underlying the technology. The attitude seems to be: if enough people agree something has value, ipso facto, it does.

Mad world

Does all that make sense? Of course not. But what people are doing with this technology is even weirder. If you want a headache, you can go and dig all this stuff up yourself, or simply visit the acerbic NFT disaster documentation site Web3 is going just great, but here are some high points of a journey I’ve now spent months on, increasingly bewildered by the new absurdities our cyberpunk dystopia creates.

- A bunch of techbros had an artist create a bunch of disgusting ape jpegs which they released as collectible NFTs that also get you access to a Discord server. In a less cursed world this would have earned yawns, or derisive laughter, but instead the Bored Ape Yacht Club has made them all bajillionaires. Not long ago they got former indie music darlings The Strokes to play an exclusive party for ape enthusiasts. Formerly reputable magazine Rolling Stone even did a puff piece on them (which was also sold as an NFT.)

- AMC, Gamestop, Ubisoft, Meta (aka Facebook) and many other large companies are cashing in on NFTs and the nebulous term “metaverse.” Even Funko Pops, those ugly vinyl collectible toys, now come with NFTs — even one debasing the memory of my favourite kitsch-art mentor, Bob Ross. Quick-moving start-ups have beaten the big companies to market, with games like The Sandbox, where you can make shitty low-poly yachts with entirely fictional features and sell them for $650,000. People from low-income countries toil in these virtual mines, earning crypto to buy bread.

- Celebrities, smelling a quick buck, have gone all-in on NFTs. Musician Grimes, former partner of a crypto enthusiast called Elon Musk, sold $6 million realdollars worth of the things. Melania Trump, partner of a frequently-bankrupted real-estate grifter, released her own line of NFTs. Absurdly, some people saw fit to buy them.

All that is just skimming the top of the crypto-NFT cesspool from the last year or so. Every day there’s some new absurdity, some ridiculous boondoggle. Just look at this dire low-energy digital “rave” that some poor cryptobro has to pretend is fun, probably because it cost an ungodly amount of money.

This is the #metaverse... A live rave happening right now in @decentraland for the upcoming @LightbulbmanNFT release by #BjarneMelgaard. Music from @feedelity @prins_thomas @mightbetwins #NFTdrop #rave #virtualevent #NFTCommunity

— Alex Moss (@alexmoss) 12:18 PM ∙ Jan 20, 2022

Then there's the infinite horror of the promotional video for a thing called Cryptoland.

The best way I can describe this video is: in the movie Event Horizon, Sam Neill's character gets a glimpse of hell. Cryptoland is what he sees.

Perhaps it was madness kicking in, but as I squinted harder into the seething migraine glare of the NFT scene, I began to see a bigger picture — a meta-picture, if you like.

The more I looked, the more NFTs seemed to have in common with another unreal scene populated by quick-buck entrepreneurs, grifters, fantasists, money-launderers, and the elite: the world of contemporary art.

Ce n'est pas une scène

To call contemporary art a grift is unfair to grifts. It is an all-encompassing, money-spinning, massively-multiplayer game of The Emperor Has No Clothes. To explain it in detail would take a few years, so you’ll have to settle for the short version: Contemporary artists compete to be platformed by a shifting roster of ultrarich patrons and insufferably smug critics who act as taste-pimps. To attract attention, artists deliberately court controversy. This race to the bottom ends up creating and celebrating ridiculous shit, offensive shit, or sometimes actual shit. And the most important rule of Contemporary Art Club is this: no-one involved in propping up this tottering edifice of absurdly overvalued literal garbage can ever admit that it’s anything less than 100 percent serious.

The real art is in making the absurd seem valuable and important, and very few artists succeed at it. This doesn’t matter, because it’s not really about artists. The system exists for the near sole benefit of the One Percent, who are incentivised to take up art appreciation by the substantial speculation opportunities, tax benefits and/or money-laundering opportunities it provides. Here’s arts patron (and former Act party branch chairman) Chris Parkin, explaining why the 2020 Parkin Drawing Prize went to an entry that was not a drawing. It explains the fundamentals of the grift better than I ever could.

“The judges are always looking for something innovative, something that’s gone a bit beyond ... it almost invariably [was going to be] something that doesn’t look in any way the conventional sense like a drawing.

“It’s totally unpredictable ... it’s a recognition that nothing in art succeeds like recognition.”

There are essentially two tiers of art: real, serious contemporary art, and everything else. Artists who prefer to focus on craft — often making “genre” art that normal people like and elite gatekeepers hate — are usually denied entry to the potentially lucrative contemporary art world. Sometimes, they’re lucky enough for their work to be co-opted (frequently without consent and/or after death) by critics wielding the demeaning term “outsider artist.”

Being unwilling to prostrate yourself before the contemporary art establishment usually means either working a day job or scraping by selling originals, prints, and merchandise, or setting up a Patreon. Success in this part of the art world is rare, is usually very hard-earned, and doesn’t even begin to compare to the fortunes amassed by successful contemporary artists like Damien Hirst.

I’d argue that NFTs are a permutation of the contemporary art model, but with a much bigger pool of participants. The world is awash with the newly crypto-rich, who can be anyone from actual investors to the lucky people who bought Bitcoin when it was cheap for shits and pizza giggles. For those who bought early and managed to “hodl,” NFTs represent something new: the ability to actually do something with your crypto.

Instead of buying black market goods, trading for other forms of cryptocurrency, or cashing out for actual money (and being taxed accordingly), you can now speculate on artwork. Both contemporary art and NFTs are a boon for money-launderers and greater-fool grifters, but NFTs make it faster and easier. If you need to instantly hose down some dirty money, just buy an NFT! And if you have a bunch of crypto burning a hole in your wallet and you’d like to make some more, just follow these four easy steps:

- List an NFT for sale

- Create a new crypto identity and buy your own NFT for a ridiculous price. Congratulations, you’ve just artificially inflated its value!

- Now you can set any price point you like for your NFT. Make it look like a bargain. "Wow, I just bought a million-dollar NFT for ten grand! What a deal!”

- Profit.

Naturally, the contemporary art machine has embraced the new grift with its many sinuous arms. Sotheby’s, one of many high-priced auction houses favored by the ultra-rich, partnered with auction site Nifty Gateway to sell The Pixel, which is literally just an NFT of a single grey pixel, for $1.3 million. The emulation of this controversy-first aspect of contemporary art might also explain why many NFTs are valued highly despite being hideously ugly.

As an artist, I…

Let’s take a step back. If artists are benefiting, does it really matter that NFTs have devolved into hype-driven memetic profiteering? To answer this question, let’s consider what an artist actually needs. We’ll do this in the time-honored form of… user stories.

As an artist, I need my work to be recognized and popular.

Can NFTs help? Maybe. If there are a bunch of cryptobros hyping up your art because they hope it will help make them rich, you’ll get popularity by proxy. However, many in the art community hate NFTs and the spammy, toxic atmosphere they generate. For a lot of artists, it may not be worth getting involved. But it’s clearly working well for some: an artist called Seneca used their profile as lead artist for the Bored Ape Yacht Club to sell NFTs of unrelated art for 23.7 ETH — at the time of writing, about $57,000 USD.

As an artist, I need for my work to be protected from theft or appropriation.

Can NFTs help? Lol, no. Art theft is rife online, and NFTs may be making it even worse. Before NFTs, one of the best ways to make a quick buck off someone else’s artwork was to put it on a t-shirt and hope you sold a few before you got caught. Now, anyone can grab your jpeg, mint it as an NFT, and make off with the proceeds. This has already happened to many high-profile artists who want nothing to do with NFTs.

As an artist, I need to be able to make a living / money from my work.

Can NFTs help? As we’ve seen from the cited examples, the answer is very much yes — if you’re very lucky. Evidence suggests that most artists are not making a killing, much less a living, from NFTs. Most sales bring in a mere pittance. To succeed, you need either an existing profile, or a unique hook that gets you noticed by someone with a lot of cryptocash to burn. A time machine might also be necessary: since the initial media frenzy, a lot of the heat has gone out of the NFT market.

NFTs also claim to make it possible for artists to profit from not only the first sale of their work but subsequent sales as well. I love this idea. While the notion of royalties has been around forever, and some countries have resale royalty schemes, it doesn’t apply to many artists. An easy, accessible alternative would be huge. But on closer inspection, it doesn’t seem to hold up. Royalties can be skipped altogether if future buyers simply switch blockchains.

So, where does this leave us? The utility of NFTs for artists seems mixed, at best. What’s more, the tide of public opinion seems to be turning. Proposals by Ubisoft to shoehorn NFTs into one of its videogames were met with fury from gamers, who are already sick of being nickel-and-dimed with real-money microtransactions. Even Beeple thinks that NFTs are “an irrational exuberance bubble.”

Then there are signs that crypto itself is tottering. While the death of cryptocurrency has been reported many times, only for it to rise again, it still has a potentially fatal flaw. Ultimately, cryptocurrency only has utility if you can cash it out for actual money. There are only a few ways to do this, using crypto exchanges and “stablecoins” pegged to a fiat currency like the US dollar, and these are coming under increasing regulatory scrutiny. China and several other countries have banned crypto outright, and other nations are toying with the idea. As I write this, Bitcoin, Ethereum, and other cryptocurrencies are tanking, with the market falling by over $1 trillion, in just a few days.

Despite all this, and despite being explicitly decried by the originators of NFT technology, the gold rush continues. Corporations are pivoting to crypto. Randoms are hoping to get rich. And artists are still trying to make a living from what they love. Some are even succeeding. Me? I’m going to stick to my principles and stay right out of it.

Just kidding.

For sale: my integrity (and artwork)

The one piece of advice I’d be prepared to offer other artists is: if you don’t want to sell a given piece, put it up for sale anyway — but at an intentionally, ridiculously high price. It’s a rare win-win for the cash-strapped: either you get to keep the thing you want, or you get enough money for it that you don’t mind. I've done it before with a couple of my paintings. Now I want to try the same thing with NFTs.

It’s long been my broadly-held belief, exacerbated by reading some libertarian dickhead called Nozick at law school, that everyone has their price. The theory goes, broadly, that while there remain some things that no amount of money will compensate for — your own life, the lives of your loved ones, etc — there’s a lot of stuff in life for which, when the chips are sufficiently down, you’ll take a payout. It’s definitely true for me. Ultra-wealthy mega-corporations like Block (Twitter) and Meta (Facebook) are embracing the ridiculous crypto-NFT-metaverse nexus. Why should I abstain, when just one good deal with the crypto devil could set my family up for life?

The idea of selling out is also motivated by a growing frustration. I've got just enough art experience and skill to know I could do a lot more. I just lack the time. Before I start to sound too self-indulgent, I should stress that being able to pursue art as a hobby is highly privileged, in the scheme of things. I have a good job and an incredible family. I don't regret prioritizing a more traditional career over art for their sake — I have pretty strong childhood memories of food bank Christmases — and I'm well aware that being a working artist is, well, hard work. But I still want to do more. I just need the time, and to buy time, you need money. I'd settle for some kind of decentralized sugar daddy.

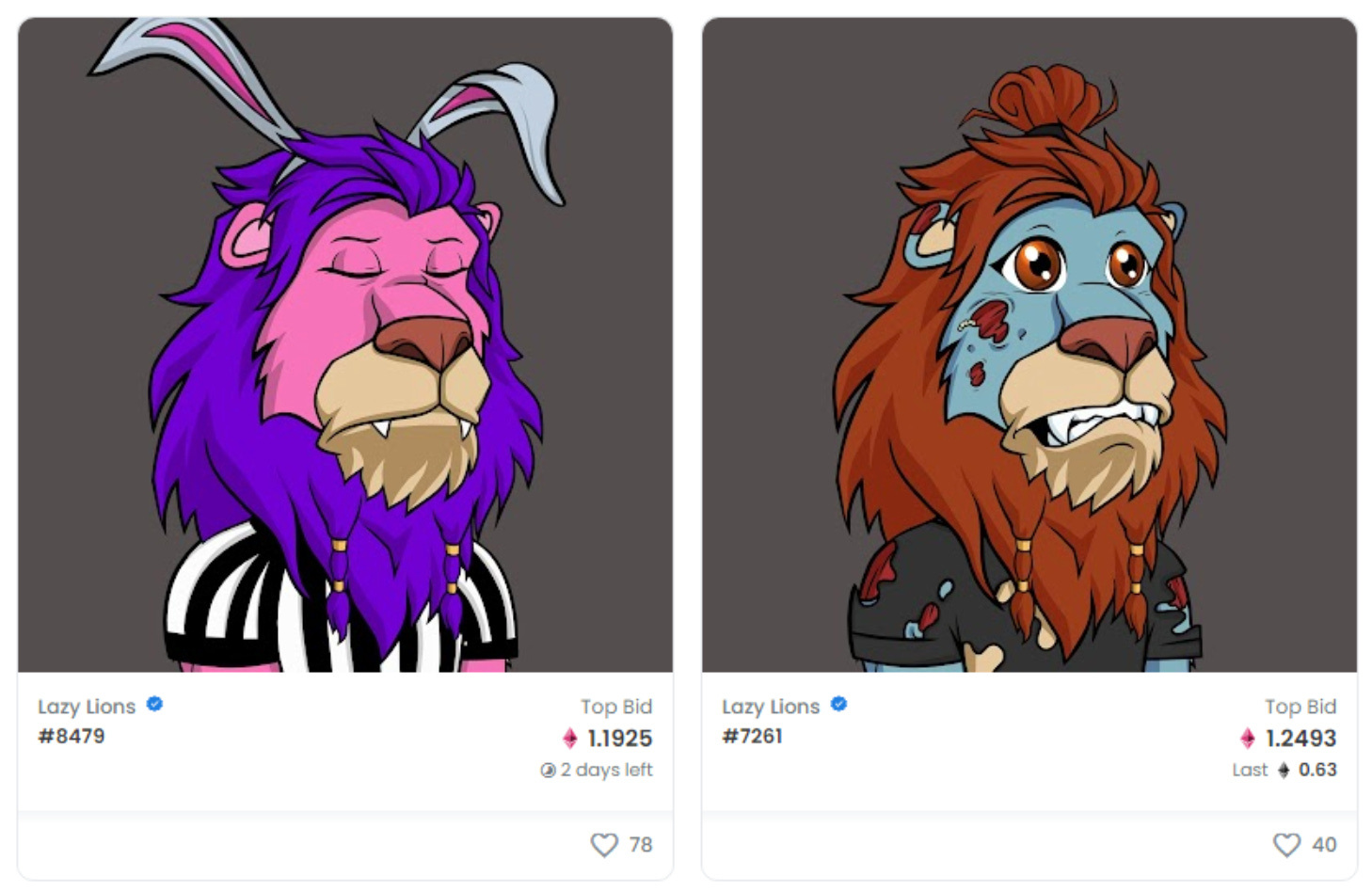

This is compounded by the fact that all the ridiculous things I see succeeding in the NFT scene are things I can do. Perhaps incorrectly, I think I could do many of them much better. Making up ridiculous meta-narratives to sell art? I did that with my viral-ish auctions, and each of my bird artworks already has a goofy little story to go with it. Exclusive communities? Sure, why not. I’m pretty sure I can set up a Discord server. As for creating art that’s worth a lot of money? As we’ve seen, it’s subjective, but I can sure as hell make stuff that looks better than these horrible fucking lions.

I don’t like NFTs or cryptocurrencies. Nor do I like the global financial system, or neoliberalism. But — for now — this rigged system is the only game in town. Without money, I can’t play, even if my only reason for wanting to is creating positive change, or having some kind of security for my wife and little boy. And I’m starting to see how tenuous that can be. The Covid-19 pandemic continues. Climate change continues. When it comes to these and other crises, governments the world over have sacrificed human lives on the altar of business continuity for wealthy power-brokers. The message has never been clearer: you don’t matter — unless you have money.

So I’m trying one last Hail Mary, with the biggest project I’ve ever attempted. I’m taking everything I’ve learned about NFT success and applying it to the most popular thing I’ve ever made: my paintings of birds wearing hats. And along the way I hope to either:

a) help prove NFTs are mostly useless for artists, or

b) eat humble pie and admit NFTs are great, actually.

The price of this humble pie? It starts at the low, low cost of… my mortgage.

That’s right: in the finest NFT and contemporary art tradition, I’m creating something utterly ridiculous, and putting an equally ridiculous price on it. Does it have any real value, any actual artistic merit? Of course not — unless you think it does. In which case, happy bidding.

This story originally ran on David Farrier’s Webworm and a follow-up piece (or two!) is edging ever-closer to completion, so I figured it was time I exposed my readers to Part One. Last time I wrote here I said I wanted to do something different and, well, this is about as different as it gets. I’m turning on comments so let me know what you think: I’m always interested in people’s feedback and — especially on this topic! — good-faith critique.

If you liked this piece (or hated it) the best way to show your support (or furious opposition) is to share it far and wide. Show your friends or bring all your mates in for a furious denouement; every little helps.

And if you really liked it, or you want to foster my lifelong dream of doing strange and/or helpful things for a living, the below button will help you give me your hard-earned money.